We have said it a million times and we will say it again: having a Chart of Accounts is critical to managing your company’s accounting. However, no matter how much the importance of a good COA is reinforced, that does not explain how to set it up, especially if you want it set up specifically for your company.

One of our clients asked for our help in setting up a chart of accounts for a real estate company, and the concept applies to all real estate companies, whether they are landlord-managed rentals, residential, or multi-unit properties. Take a look at what we said.

Q: I need help setting up a proper chart of accounts for a real estate company that has three separate checking accounts for normal, commissions, and escrow.

A: QuickBooks categorizes accounts as:

The three accounts you are asking about—a normal checking account, a commissions checking account, and an escrow checking account—are all asset accounts, so you can add them in very easily.

(If you happen to be creating a new company file, select Property Management, Home Owner Association, or Rental as your industry. When you do this, QuickBooks automatically customizes your income and expense accounts for you!)

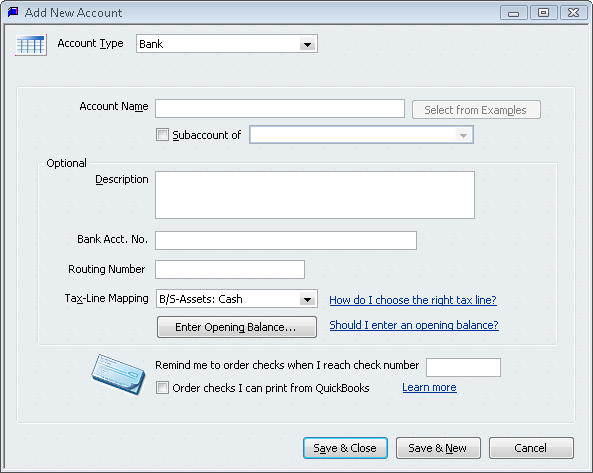

If you need to add a new account, the steps are pretty simple:

Typically you would name that accounts by the last four digits as well as the type of bank account. So, with your three accounts, the account names would be something like Checking 1234 (for the normal account), Checking 5678 (for the commissions account), and Checking 9000 (for the escrow account). You can add the use of each account in the description box.

(It is important to note that if these accounts belong to different banks, you would include the bank name in the account name—for example, your commissions account from Wells Fargo would be named Wells Fargo Checking 5678).

Once you have filled the fields with the appropriate information, and then click Save & Close (or, if you want to create another new account, click Save & New). You can do this for all of the account types that you want!

If you need more help on how to use QuickBooks for property management, you can take a sneak peek into our Landlord’s Guide to Financial and Property Management. This guide helps you discover a quick and easy solution to all of your financial and property management needs. Packed with tips, tricks, and techniques, every task is explained in detail, supplemented by screenshots and step-by-step instructions.

A Landlord’s Guide to Financial and Property Management will give you a solid foundation for the organization of your real estate business and get you on track to obtaining even greater profits. Sign up below for an exclusive sneak-peek into this all-you-need-to-know guide.